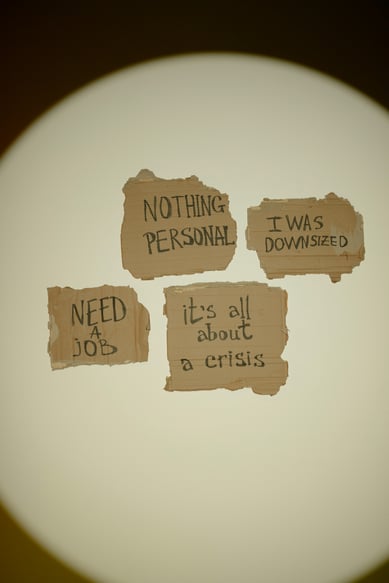

In the aftermath of the pandemic, businesses continue to face significant workforce challenges — from adjusting to remote work to weathering economic instability. While many companies strive to avoid workforce reductions, layoffs are sometimes inevitable. For insurance agents, these moments present an opportunity to act as trusted advisors, helping clients manage the legal and financial risks that may arise during periods of downsizing.

Protecting Against Liability During Layoffs

While layoffs may reduce overhead costs in the short term, they can expose companies to significant liability. Former employees may feel they were dismissed unfairly, opening the door to lawsuits based on perceived discrimination, wrongful termination, or procedural errors. For small and midsize businesses without in-house HR resources, this risk can be even greater.

To help clients protect themselves, agents can begin by asking the right questions. Has the employer clearly defined the criteria for layoffs — such as seniority, performance, or skill set? Have performance reviews been documented to support termination decisions? Is there a plan for severance in exchange for legal waivers? And how will the layoff be communicated to both impacted employees and the broader organization?

Why EPLI and D&O Coverage Are Essential for Layoff-Related Risk Management

Insurance agents should also discuss the importance of Employment Practices Liability Insurance (EPLI). EPLI offers financial protection if a company is sued over workplace issues such as discrimination or wrongful termination. For many small business owners, the risk of an EPLI claim is far more likely than a catastrophic event like a fire — yet coverage is often overlooked.

Another important policy to consider is Directors & Officers (D&O) Insurance. This coverage protects company leaders if they’re sued over decisions made during financial hardship, including those that lead to layoffs. D&O policies typically cover legal defense costs, settlements, and other expenses associated with allegations of mismanagement or breach of duty.

Insurance coverage — paired with careful planning and documentation — can ultimately reduce a business’s exposure and safeguard its future.

At AAI, we empower agents to provide this kind of strategic support by offering access to top carriers, marketing expertise, and advanced tools. Want to grow your independent agency while making a bigger impact? Contact us today to learn more.

This may apply to 2 or 3 of our agents. This is geared to large commercial producers which unfortunately we are not attracting right now, nor do we have the resources to support this type of agent